Framework

Our world view, systems analysis, and investment framework are based upon first principles and biomimicry — additional details here.

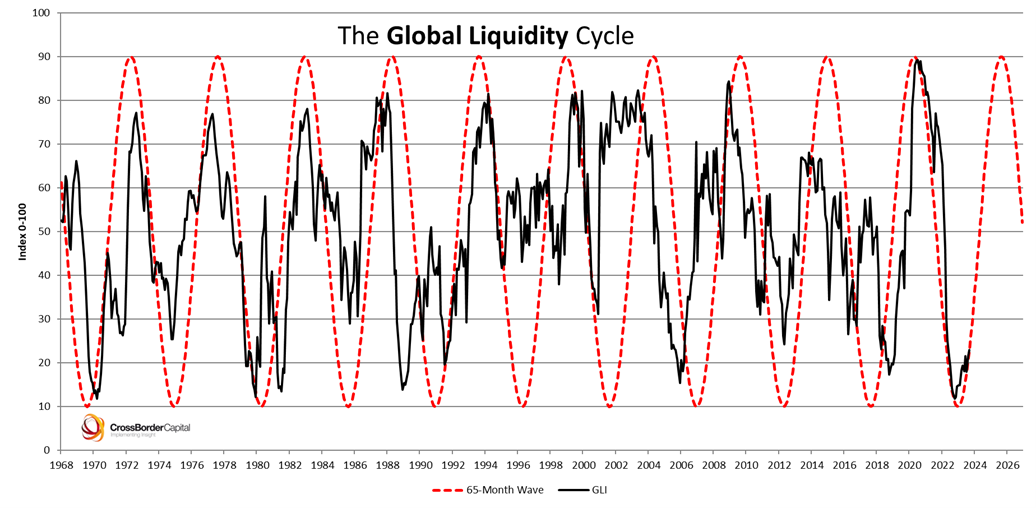

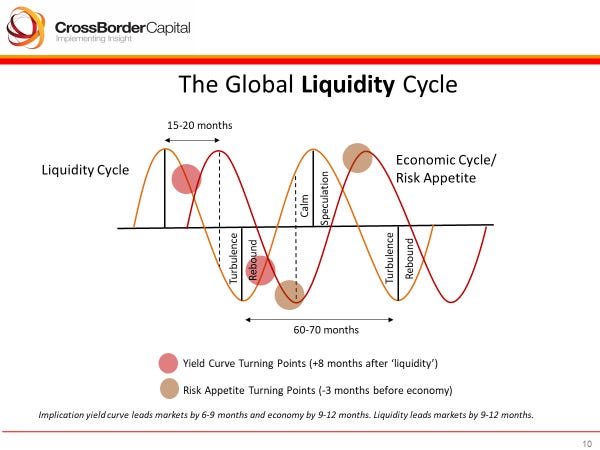

We study history to learn and apply this wisdom to the present and future. While history typically doesn’t repeat exactly, it often rhymes. And these natural, wave-like rhythms show up across society, markets, politics, technology across varying time scales.

Just as self-similar patterns — known as fractals — appear throughout Nature, similar patterns repeat at varied scales throughout markets and history. We seek to utilize this pattern recognition to capitalize on markets and proactively prepare for what is likely to come.

Designed with the principles of Nature — where fractals (e.g., rivers, trees), waves (e.g., ocean, sound), and cycles (e.g., seasons, life) are inherent — our framework breaks down the components of the overall system to help us better understand these patterns, why they repeat, where we likely are on these various waves, and the most likely path(s) ahead. A few of the most important macro-level frameworks we utilize are below:

Demographics

Finance

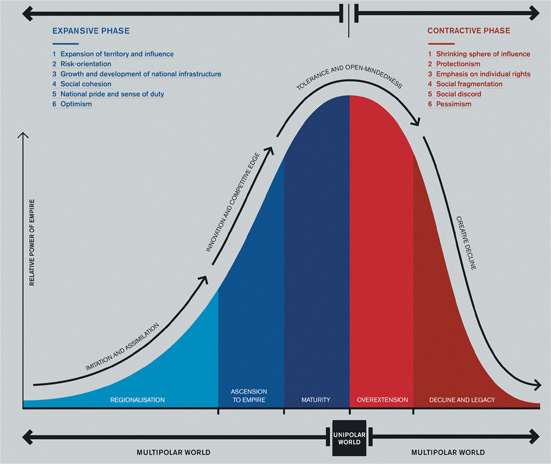

Empires

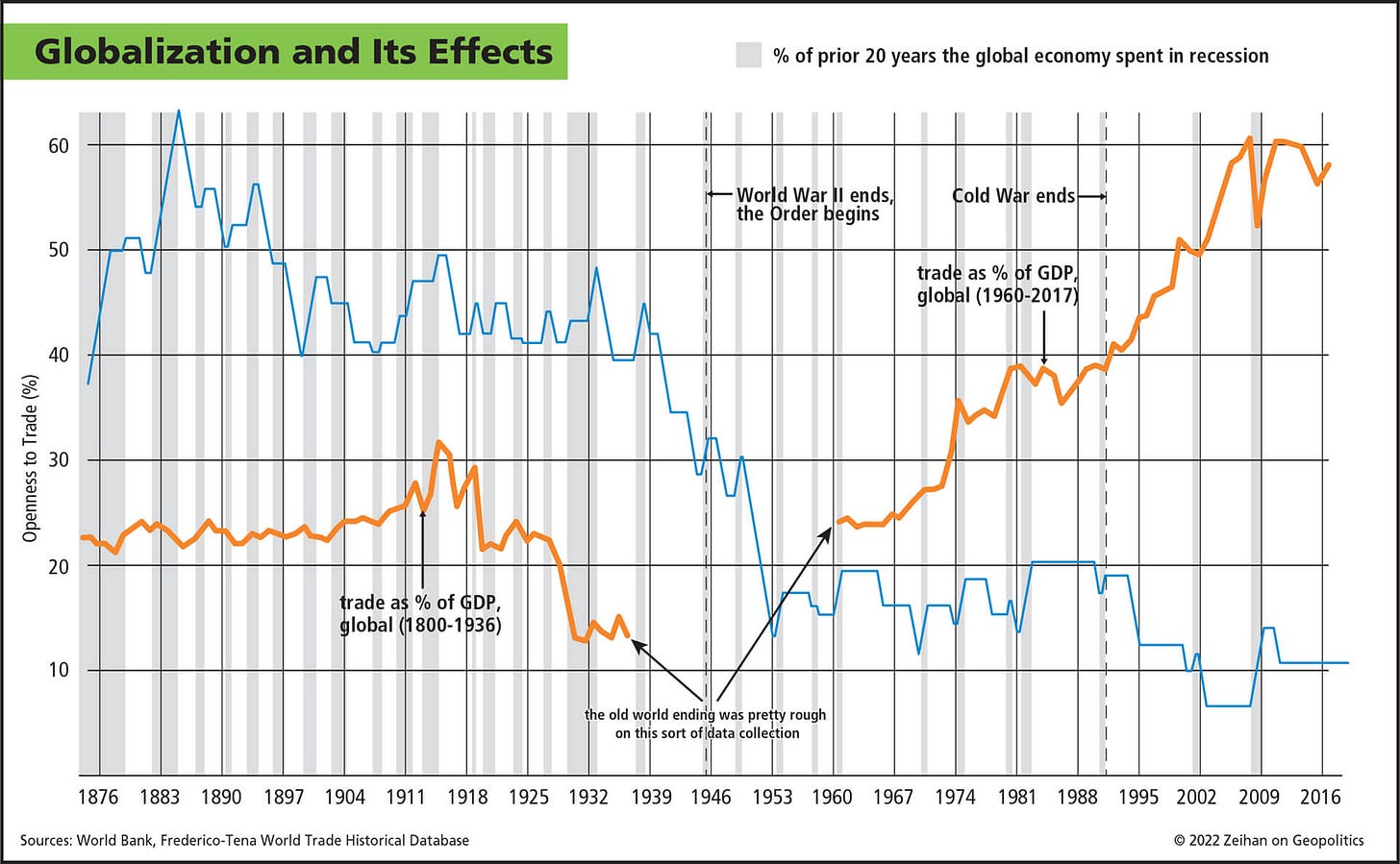

Geopolitics

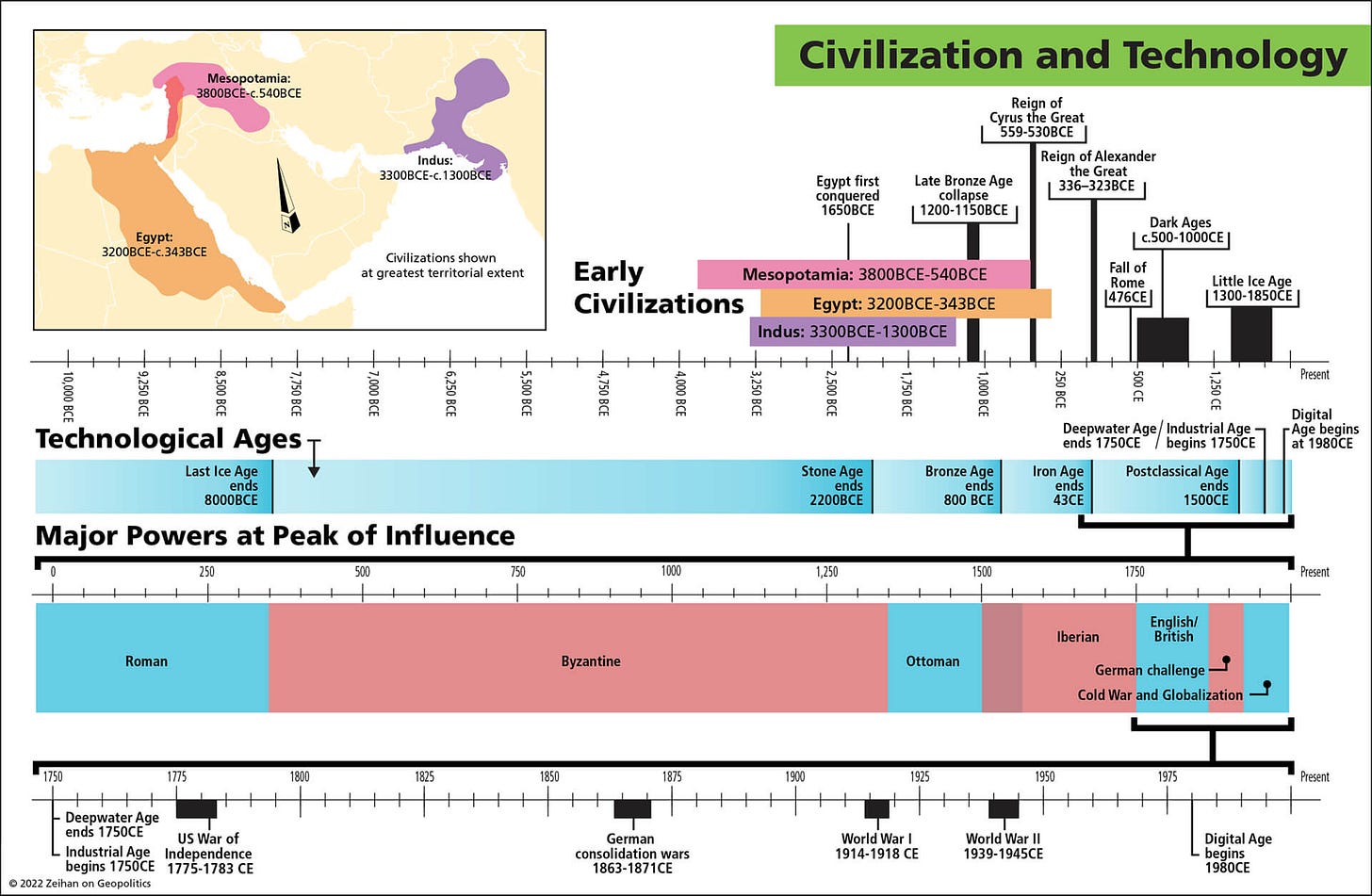

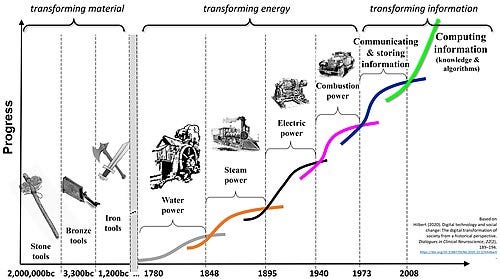

Technology

Markets

We spend a lot of time curating the best thinkers in their respective fields, delving deeply into their research, thought processes, and track records, and ultimately adapting our learnings into our own framework — bundling the unbundled. We are not experts in each field, but by listening and utilizing this curation process, we can ‘stand on the shoulders of giants’ — using each as a building block to raise our awareness and understanding of the system.

Piecing together these often overlapping sub-system cycle frameworks — from Demographics to Technology — the bigger picture, longer timeframe backdrop becomes clearer. We map these multiple waves so we can better pinpoint where we are within each of the respective cycles and create a current holistic picture for the overall system (topic for another post).

We then use this long-cycle picture to understand the secular trends that are likely to be persistent for years, if not decades. The themes (and sub-themes) that come out of this analysis are then paired with our areas of expertise — this combination provides a filter for “where to fish” and helps us generate our overall Universe.

Our themes — and thus our strategies — revolve around the three major pillars or building blocks of Power that have been consistent across history: Technology, Energy, & Money. We delve into each sphere in a separate piece.

From here, we utilize a variety of qualitative and quantitative tools — from fundamental analysis to strategic positioning to technicals — to analyze the curated Universe. The customized versions of these tools are rooted in the mathematical principles found in Nature — from Fibonacci numbers, to Golden Primes, and Elliot Waves. And we apply the Natural sciences of Physics and Biology directly to better understand the intricacies of the complex adaptive system.

Generally, Physics helps us understand the dynamics of the market structure and system as a whole — particularly helpful for higher level idea generation and risk management. Biology helps us understand the competitive environment and the companies (‘organisms’) most likely to survive and thrive within the system — delving deeper to identify specific resilient and adaptable assets (‘Complexity Investing’). With this cross-discipline approach, rooted in the principles of Nature, we are better able to “listen” to what the system and its components are telling us, rather than impose our emotional and cognitive biases.

In addition, we overlay several of our other custom-built filters — from quality analysis to incentive alignment (critical principle of ours) — to narrow down the field even further. At the bottom of the funnel, the outputs are actionable ideas coupled with a better understanding of why. We ultimately look for ideas that are both at the confluence of our themes — the center of the Venn diagram — and at the bottom of the funnel.